Role of a financial controller

What does a financial controller do, and how they add value?

The role of a financial controller is a tricky one to define. These employees are responsible for the management and leadership of accounting departments, as well as contributing to the overall financial strategy and direction of the business.

Typically, financial controllers are the organisation’s lead accountant, but the role is not limited to number crunching and overseeing the day-to-day accounting process. They have a keen eye for detail, are meticulous in their approach to financial analysis, are savvy business professionals and have a strong understanding of operations and strategy. Often involved in more than just accounting, financial controllers are versatile members of staff with wide skill sets.

What is a financial controller?

A financial controller is responsible for overseeing an organisation’s accounting activities and ensuring that all financial reporting is accurate and up-to-date. They also advise senior management and directors, often contributing to key business decisions regarding future strategy.

Financial Controllers must possess both technical and analytical skills in order to be effective at their job. They must have a thorough understanding of accounting principles such as budgeting, forecasting, cash flow management, cost control and auditing practices. As part of their role, financial controllers must also be adept at using a variety of software and programs in order to analyse data accurately and generate meaningful reports. These include but are not limited to:

- Spreadsheets (Microsoft Excel, Google Sheets)

- Accounting Platforms & Software

- Payment Processing Tools

- Expense Management Software

And much more…

If you’re familiar with the world of finance or work within a financial department, chances are that you’ve heard of this job role, but you might not have fully appreciated how they are contributing to your organisation.

How do they add value to business?

The true value of a financial controller comes from their skill and experience in understanding and interpreting financial data to generate actionable insights that reduce costs, maximise profitability, and comply with complex legislation.

Financial controllers are able to develop cash management processes and tax plans, as well as develop strategies for budgeting and cash flow analysis, making sure that money is used correctly. This can lead to improved profitability by preventing overspending on activities or services not needed by the business.

Furthermore, controllers help businesses stay compliant with regulations and filing requirements relating to taxes or other financial obligations. They keep track of all these rules, so companies don’t have to worry about getting fined or penalised for noncompliance.

A financial controller will also be able to forecast future financial trends and advise the company when needed. This knowledge can help direct managerial decisions and lead to greater operational efficiency and cost savings.

Financial controller role: Key responsibilities and duties

The financial controller is responsible for managing the accounts department and ensuring that everything is running smoothly and efficiently. While a team of accountants handles more administrative duties, the financial controller focuses on ensuring the smooth operation of the company’s financial department, delegating tasks to their team. Their daily tasks may include:

- Analysing financial records

- Reporting to senior management

- Creating financial reports

- Monitoring the performance of the department

- Conducting audits

- Managing tax and regulatory compliance

- Participating in financial strategy discussions

Salary

The role of a financial controller is a very lucrative one, with the average annual salary in the UK ranging anywhere from £50,000 to £80,000. More experienced finance professionals, particularly those based in the London Area, can expect to earn as much as £100,000+.

Improve your financial controls with Volopa.

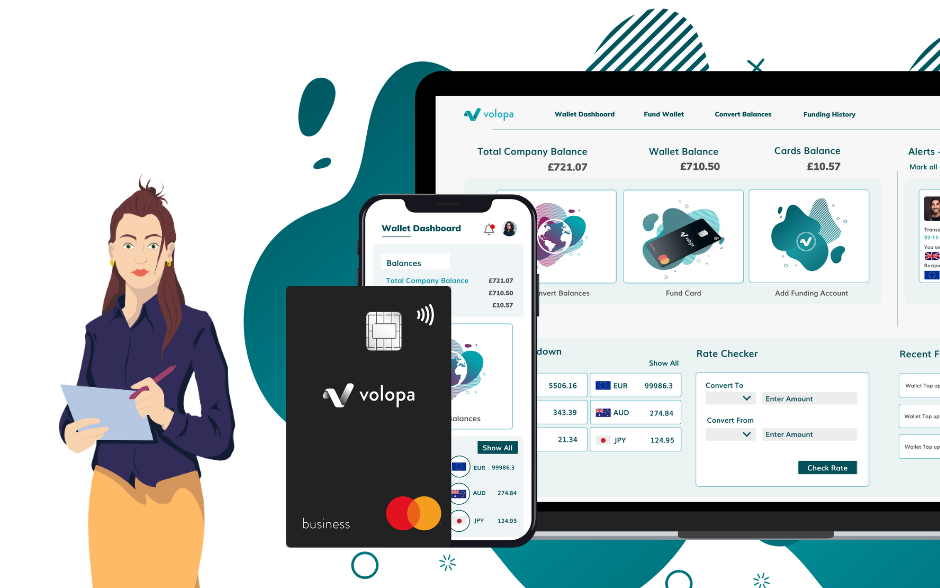

Having strong financial controls within your organisation is the key to a fully-compliant, profitable, and successful business. At Volopa, we offer a leading expense management solution to help your finance team manage budgets and employee spending.

With our prepaid business cards, you can track and control how money is being spent across the business instantly using our mobile and desktop apps. Send funds, set spending limits, freeze cards, and capture receipts all at the touch of a button, helping you to maintain a strong hold on your finances. With the option for accounting software integration with tools such as Xero and Quickbooks, managing budgets and company finances has never been easier.

Our international payments solution allows businesses to save on costs associated with traditional methods of international money transfer, which typically have high transaction fees and unfavourable exchange rates. Moreover, our recipient email function simplifies the process of keeping vendors and suppliers updated on the status of their payments. This feature enables businesses to easily track and manage their outgoing payments, providing greater visibility and control over their finances.

If you have a Financial Controller within your organisation, why not make their job easier with our prepaid business cards and expense management software? Complete our signup form to get started today, or contact the team for more information.

FAQs

A financial controller is an important position within the finance department of any organisation. From setting budgets, tax planning, and auditing accounts to tracking investments, a financial controller is responsible for managing the company’s finances and providing insightful information to aid key business decision-making.

If you’re looking for a career in financial management, the job of a financial controller should potentially be at the top of your list. It is the highest position of authority within most accounting departments with great earning potential. It can also be very rewarding for those interested in finance. However, the role is known to be quite stressful at times.

A financial controller typically reports to the chief executive or financial director of an organisation. The controller acts as a bridge between all areas of business and ensures compliance with applicable laws and regulations.

Some organisations have a comptroller, which is a slightly different role to a financial controller or CFO (Chief Financial Officer). While a financial controller is responsible for the day-to-day financial operations, a comptroller is more likely to be responsible for managing projects related to taxes, auditing and compliance with regulatory agencies.

Financial controls are important for

1. ensuring that financial operations remain compliant with laws and regulations

2. monitoring company finances and detecting fraudulent activities or mismanagement

3. protecting profitability by avoiding costly mistakes or legal repercussions.

Learn more about Volopa’s expense management software

If you are interested in hearing more about our expense management solutions in order to reduce the likelihood of expense fraud within your organisation, get in touch with the Volopa team today!

You can book a demo of our software to try before you buy, helping you to start your Volopa journey with full confidence.

Find out more about what Volopa can do for you