Keep track of your team’s expenses and equip them with the tools they need to complete their tasks efficiently.

- Order prepaid cards for your employees for free

- Fund your multicurrency Company Wallet in GBP, EUR, or USD, and convert balances to any of the 14 supported currencies.

- Load your employees’ cards in any of the 14 supported currencies

Set maximum transaction values per card, enable or disable transaction types and automatically load individual cards from the Company Wallet. Post-spending, don’t waste time calculating expenditure, VAT, recording transactions or producing reports. The Volopa Business App can takes care of all of this and more.

Are you a small business in need of your time back? Eliminate the chore of expense admin with Volopa’s expense management platform, app, and employee expense cards.

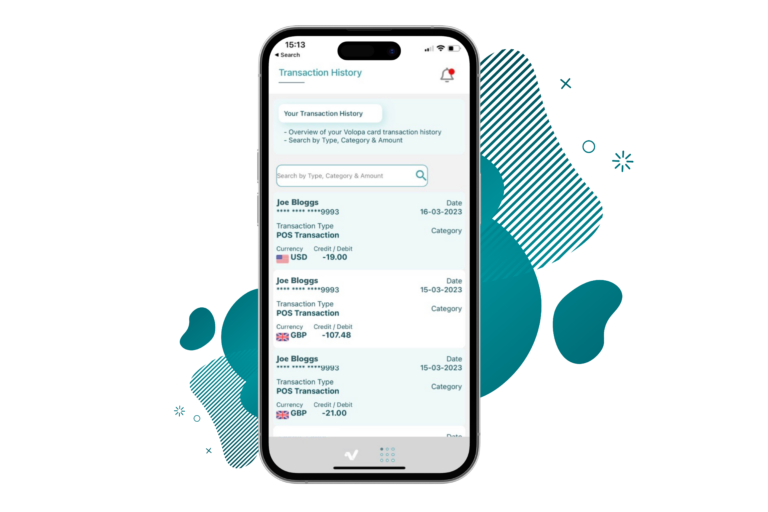

Employees can manage their individual cards, capture receipts and add notes to their transaction via the Volopa Business app. Available for download on Android or iOS.

Allow employees to spend in multiple currencies locally and globally, add notes to expenses, see your card balance at any time, and get instant notifications on transactions.

Set transaction limits by card and track expenditure in real time. Approved by the FCA, our service allows you to disable transactions or freeze and unfreeze cards at your discretion.

Download the app and manage currency exchange, receipt capture, VAT calculations, automated reports and much more from the tip of your fingers.

Gone are the days of cashing out on individual company cards one-by one. Top up for employee spending all in one place with the Shared Company Wallet. Gain complete visibility over all employee real-time spending in one dashboard.

There are a number of benefits to a business and its employees from using prepaid cards. Businesses gain greater control over spending by being limited to what is on the card, thus the risk of overspending is mitigated. Why? Because they’re easy to reload with home and foreign currencies, which means they can be used anywhere in the world without the risk of expensive fees like traditional debit or credit cards.

Small business, especially, can also gain greater control over spending by setting daily transaction limits and limiting the amount loaded on each card. This is more secure for business finances as well as the event of theft, where the card can be frozen immediately in-app.

To top it all off, not only do you not have to worry about the potential interest charges from company credit cards, prepaid corporate cards also offer real time reporting and management. The Volopa mobile app is a game changer and allows admins to categorise individual transactions, calculate VAT, integrate into accounting systems like QuickBooks, Sage and Xero, saving precious admin time.

Business prepaid cards offer greater control and convenience than debit or credit cards. They offer greater flexibility over how business finances are managed, due to being connected to a virtual wallet and app. Unlike traditional debit cards, prepaid cards can be topped up and frozen as needed

Whereas credit and debt cards can charge fees for use abroad, Volopa prepaid cards are designed to be used abroad, supporting this with in-app currency exchange for various currencies.

They make for safer finances as no more can be spent than is deposited on the card. This also makes budgeting much easier.

Setting up prepaid cards for business use is simple. With Volopa, this can be done in 6 steps.

- Set up a user account and add security information

- Add all personal details on this account

- Add company details

- Select the services you would like the card to include

- Input an estimate on expected usage and spending

- We confirm that the account has been created

Yes, prepaid cards are great for business trips abroad- and for many reasons.

Prepaid cards free up your wallet and time. There’s no need to carry/ go to convert currency, making it a much safer option for employees as well.

With Volopa’s company wallet, you can load up to 14 different currencies on to one card, making it great for travels to the US, Europe and far beyond. With real-time currency exchanges included, you always get the accurate rates whenever you need to top up.

Furthermore, once back home, you can switch to GBP and carry on using the one card at home as well as abroad.