Product Update

We've partnered with ClearBank!

Empowering SMEs with advanced solutions powered by ClearBank: Find out more about the Volopa and ClearBank's Partnership

We are thrilled to announce a transformative partnership with ClearBank, a leader in real-time clearing and embedded banking. This collaboration is not just a business move; it's a strategic leap forward in our mission to provide comprehensive, innovative financial solutions that cater specifically to the needs of SMEs.

Why we chose ClearBank

Our decision to partner with ClearBank was driven by our commitment to enhance and expand the services we offer to our clients. ClearBank’s technology-enabled clearing bank capabilities align perfectly with our vision of delivering real-time payment and banking solutions. By integrating ClearBank’s robust technology platform, we are set to offer seamless access to UK payment rails, facilitating faster and more efficient transfers to individuals, businesses, and other financial institutions.

What this means for our clients

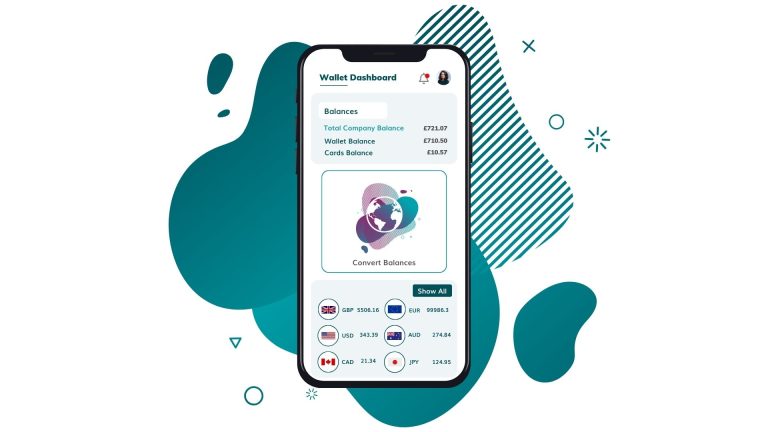

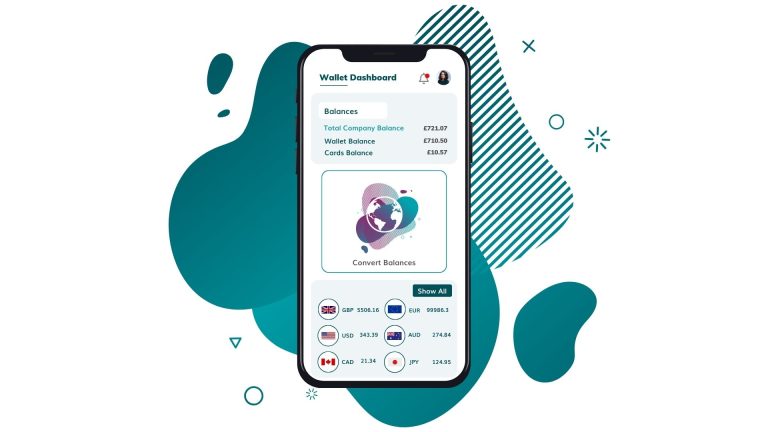

With ClearBank by our side, we’re enhancing our existing services and preparing to introduce new capabilities. Once we secure our e-money licence from the Financial Conduct Authority (FCA)—our clients will enjoy access to safeguarded bank accounts and virtual accounts, adding to our suite of multicurrency and cross-border payment solutions.

Our vision for the future

This partnership marks a crucial step in our journey of growth and innovation. It allows us to not only meet the current demands of our clients but also to think ahead and prepare for future needs. The integration of ClearBank’s technology will empower our clients with tools that are not just about managing money, but optimising it, whether it’s through streamlined global payments, multicurrency transactions, or enhanced expense management.

Looking ahead

We are excited about the potential this partnership holds. As we integrate our systems and roll out new services, we are confident that the synergy between Volopa and ClearBank will not only strengthen our current offerings but also enable us to innovate and expand in ways that will redefine how SMEs manage their finances.

We are immensely proud to be at the forefront of this exciting phase in financial technology. With the backing of Quantum Group and the potential public listing in the near future, our horizon is expansive and promising.

We remain dedicated to our mission of unlocking the potential of businesses through simpler, faster, and more transparent payment solutions. We look forward to growing alongside our clients and setting new benchmarks in the financial services industry.

For more information on our services and future developments, stay connected through our website and updat

Securing the best exchange rates

Generally speaking, both banks and payments providers charge a margin, typically via a commission or a percentage-spread, for converting currencies from the funding currency (what you send them) to the payment currency (what the recipient receives). Banks are traditionally risk averse to currency movements due to the size of the portfolio of client assets they hold in multiple currencies. Any shock movement within the currency market can amount to significant losses, and in a bid to mitigate this risk, banks tend to apply higher margins.

International payments providers generally take a different approach, utilising live rates which they transact with immediately. Using this methodology, they don’t need to hold on to funds, the risk is less, and margins can therefore be much lower amounting to better exchange rates for their clients.

Payment Speed

Just as a bank cheque takes time to deposit into an account, so does sending money from one country to another. International FX payments can often take days to reach your recipient if sent via your bank. This is because banks often use manual currency conversion processes and tend to send funds via costly legacy banking networks. If you wish to transfer funds quickly, banks may not be your best option.

Specialist payments providers have established “points-of-difference” in the international payments market through innovative solutions to enable same-day international payments using more robust platforms and security systems. Specialist payment providers tend to route international payments via newer alternative payment rails that are quick, low-cost and easy to track, meaning recipients receive their payments in full and on time, while payment initiators can stay up to date with their payment statuses.

Conclusion

Whilst a bank may provide familiarity, specialised payments providers can offer better FX and payments expertise, superior technology and more cost-effective exchange rates. Through the tailoring of solutions and streamlining compliance requirements, services provided are largely more client-centric and focused. This often amounts to lower fees and charges as well as a superior customer experience for their clients.

Product Update

We've partnered with ClearBank!

Empowering SMEs with advanced solutions powered by ClearBank: Find out more about the Volopa and ClearBank's Partnership

We are thrilled to announce a transformative partnership with ClearBank, a leader in real-time clearing and embedded banking. This collaboration is not just a business move; it's a strategic leap forward in our mission to provide comprehensive, innovative financial solutions that cater specifically to the needs of SMEs.

Why we chose ClearBank

Our decision to partner with ClearBank was driven by our commitment to enhance and expand the services we offer to our clients. ClearBank’s technology-enabled clearing bank capabilities align perfectly with our vision of delivering real-time payment and banking solutions. By integrating ClearBank’s robust technology platform, we are set to offer seamless access to UK payment rails, facilitating faster and more efficient transfers to individuals, businesses, and other financial institutions.

What this means for our clients

With ClearBank by our side, we’re enhancing our existing services and preparing to introduce new capabilities. Once we secure our e-money licence from the Financial Conduct Authority (FCA)—our clients will enjoy access to safeguarded bank accounts and virtual accounts, adding to our suite of multicurrency and cross-border payment solutions.

Our vision for the future

This partnership marks a crucial step in our journey of growth and innovation. It allows us to not only meet the current demands of our clients but also to think ahead and prepare for future needs. The integration of ClearBank’s technology will empower our clients with tools that are not just about managing money, but optimising it, whether it’s through streamlined global payments, multicurrency transactions, or enhanced expense management.

Looking ahead

We are excited about the potential this partnership holds. As we integrate our systems and roll out new services, we are confident that the synergy between Volopa and ClearBank will not only strengthen our current offerings but also enable us to innovate and expand in ways that will redefine how SMEs manage their finances.

We are immensely proud to be at the forefront of this exciting phase in financial technology. With the backing of Quantum Group and the potential public listing in the near future, our horizon is expansive and promising.

We remain dedicated to our mission of unlocking the potential of businesses through simpler, faster, and more transparent payment solutions. We look forward to growing alongside our clients and setting new benchmarks in the financial services industry.

For more information on our services and future developments, stay connected through our website and updat

Securing the best exchange rates

Generally speaking, both banks and payments providers charge a margin, typically via a commission or a percentage-spread, for converting currencies from the funding currency (what you send them) to the payment currency (what the recipient receives). Banks are traditionally risk averse to currency movements due to the size of the portfolio of client assets they hold in multiple currencies. Any shock movement within the currency market can amount to significant losses, and in a bid to mitigate this risk, banks tend to apply higher margins.

International payments providers generally take a different approach, utilising live rates which they transact with immediately. Using this methodology, they don’t need to hold on to funds, the risk is less, and margins can therefore be much lower amounting to better exchange rates for their clients.

Payment Speed

Just as a bank cheque takes time to deposit into an account, so does sending money from one country to another. International FX payments can often take days to reach your recipient if sent via your bank. This is because banks often use manual currency conversion processes and tend to send funds via costly legacy banking networks. If you wish to transfer funds quickly, banks may not be your best option.

Specialist payments providers have established “points-of-difference” in the international payments market through innovative solutions to enable same-day international payments using more robust platforms and security systems. Specialist payment providers tend to route international payments via newer alternative payment rails that are quick, low-cost and easy to track, meaning recipients receive their payments in full and on time, while payment initiators can stay up to date with their payment statuses.

Conclusion

Whilst a bank may provide familiarity, specialised payments providers can offer better FX and payments expertise, superior technology and more cost-effective exchange rates. Through the tailoring of solutions and streamlining compliance requirements, services provided are largely more client-centric and focused. This often amounts to lower fees and charges as well as a superior customer experience for their clients.

Securing the best exchange rates

Generally speaking, both banks and payments providers charge a margin, typically via a commission or a percentage-spread, for converting currencies from the funding currency (what you send them) to the payment currency (what the recipient receives). Banks are traditionally risk averse to currency movements due to the size of the portfolio of client assets they hold in multiple currencies. Any shock movement within the currency market can amount to significant losses, and in a bid to mitigate this risk, banks tend to apply higher margins.

International payments providers generally take a different approach, utilising live rates which they transact with immediately. Using this methodology, they don’t need to hold on to funds, the risk is less, and margins can therefore be much lower amounting to better exchange rates for their clients.

Payment Speed

Just as a bank cheque takes time to deposit into an account, so does sending money from one country to another. International FX payments can often take days to reach your recipient if sent via your bank. This is because banks often use manual currency conversion processes and tend to send funds via costly legacy banking networks. If you wish to transfer funds quickly, banks may not be your best option.

Specialist payments providers have established “points-of-difference” in the international payments market through innovative solutions to enable same-day international payments using more robust platforms and security systems. Specialist payment providers tend to route international payments via newer alternative payment rails that are quick, low-cost and easy to track, meaning recipients receive their payments in full and on time, while payment initiators can stay up to date with their payment statuses.

Conclusion

Whilst a bank may provide familiarity, specialised payments providers can offer better FX and payments expertise, superior technology and more cost-effective exchange rates. Through the tailoring of solutions and streamlining compliance requirements, services provided are largely more client-centric and focused. This often amounts to lower fees and charges as well as a superior customer experience for their clients.

Securing the best exchange rates

Generally speaking, both banks and payments providers charge a margin, typically via a commission or a percentage-spread, for converting currencies from the funding currency (what you send them) to the payment currency (what the recipient receives). Banks are traditionally risk averse to currency movements due to the size of the portfolio of client assets they hold in multiple currencies. Any shock movement within the currency market can amount to significant losses, and in a bid to mitigate this risk, banks tend to apply higher margins.

International payments providers generally take a different approach, utilising live rates which they transact with immediately. Using this methodology, they don’t need to hold on to funds, the risk is less, and margins can therefore be much lower amounting to better exchange rates for their clients.

Payment Speed

Just as a bank cheque takes time to deposit into an account, so does sending money from one country to another. International FX payments can often take days to reach your recipient if sent via your bank. This is because banks often use manual currency conversion processes and tend to send funds via costly legacy banking networks. If you wish to transfer funds quickly, banks may not be your best option.

Specialist payments providers have established “points-of-difference” in the international payments market through innovative solutions to enable same-day international payments using more robust platforms and security systems. Specialist payment providers tend to route international payments via newer alternative payment rails that are quick, low-cost and easy to track, meaning recipients receive their payments in full and on time, while payment initiators can stay up to date with their payment statuses.

Conclusion

Whilst a bank may provide familiarity, specialised payments providers can offer better FX and payments expertise, superior technology and more cost-effective exchange rates. Through the tailoring of solutions and streamlining compliance requirements, services provided are largely more client-centric and focused. This often amounts to lower fees and charges as well as a superior customer experience for their clients.