Volopa Launches Collections

Streamline your global payment processes with Volopa’s new collections service

Volopa is excited to announce the launch of our powerful Collections solution, designed to simplify and streamline your international payment processes. Whether you’re managing clients abroad or collecting payments locally, this feature will transform the way you handle your incoming payments —allowing you to focus on business growth while we take care of the complexities of cross-border payments.

What can you achieve with Volopa’s Collections?

With Volopa’s new capability, your business can:

- Local accounts in 3 major currencies

Use local accounts in GBP, USD and EUR to collect payments from your clients as if you were a local, eliminating the typical delays and costs of international transfers. - Collect payments in 17 currencies

Receive funds, including major currencies like USD, EUR, and GBP, with seamless support for managing multi-currency transactions - Dedicated account number

Simplify reconciliation with a unique account number assigned to your business, giving you greater transparency and ease of use. - Convert funds using Volopa’s competitive exchange rates

Convert received funds into your preferred currency at Volopa’s competitive exchange rates, make payments directly or transfer them back to your company’s main bank account, maximising value on every transaction. - Load directly to your Volopa wallet or make a payment

Use your collected funds instantly – load them to your Volopa Company Wallet, making it easy to fund company expenses or pay suppliers directly. - Improve cash flow and payment security

Get access to your funds faster and more securely with our streamlined collection process. - Full visibility and real-time reporting

Track every payment received with comprehensive transaction histories and real-time updates. - Compliance & security

Be assured that every transaction meets the highest standards of FCA and international financial regulations, keeping your business compliant and protected. - Competitive fees & transparent costs

Enjoy competitive fees and exchange rates, with no hidden costs, making it easier to manage your global collections.

Why Choose Volopa’s Collections?

Our solution is built to take the stress out of cross-border collections, allowing your business to manage global payments as seamlessly as if they were local. By using Volopa’s local collection accounts and SWIFT payments, you can collect funds from partners and clients anywhere in the world, while benefiting from Volopa’s competitive rates and superior service.

Transform your business collections process

Whether you’re dealing with clients in Europe, the US, Asia, or beyond, Volopa’s Collections service provides a reliable system that ensures your payments are received securely and efficiently. With the ability to manage collections, payables, and currency conversions all in one platform, Volopa’s solution optimises your cash flow and minimises the administrative burden of international transactions.

Get started today

Want to see how Collections can integrate into your existing operations? Contact us today to schedule a quick demo or to learn more about how Volopa can help you streamline your global payments.

Collections

FAQs

Collections allows businesses to receive payments from both local and international clients directly into their Volopa account in 17 supported currencies. Each business is provided with a dedicated account (e.g., IBAN, SWIFT/BIC, and for some currencies, local account numbers) that can be shared with clients or partners to receive payments. Funds received can then be used to load your company wallet or make payments directly from your account.

You can collect payments in 17 currencies, including major ones like GBP, EUR, USD, CAD AUD, CHF, JPY, and SGD. For some currencies, such as GBP, USD, and EUR you will also have access to local collection accounts to receive payments faster and at a lower cost.

No, there is no additional fee for accessing the Collections feature. However, standard transaction and conversion fees will apply depending on the nature of the received funds and any conversions made using our competitive exchange rates.

The Collections feature is enabled by default for clients with access to international payments. If you’re a new client or don’t see the option in your account, please complete the expected usage form in your application or contact our support team at customersupport@volopa.com.

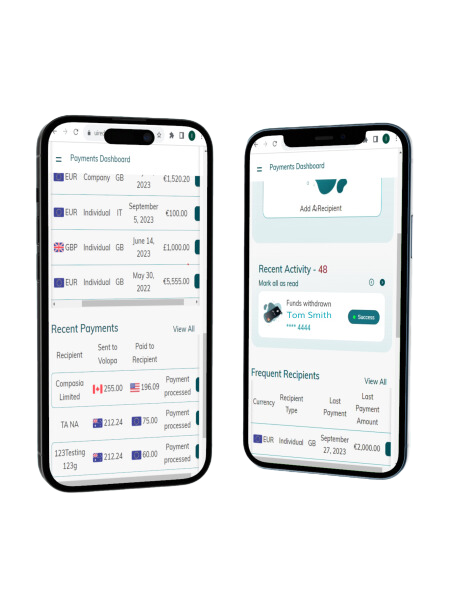

Once logged into your Volopa web app, navigate to the Collections page to view your dedicated account details for each currency. You can then share these details with your clients or business partners for them to make payments directly to your Volopa account.

When funds are received, they are held securely in your Volopa Collections account and are visible in the Collections History section. You can then choose to load these funds into your company wallet, use them to make payments, or convert them to your preferred currency and send to your main bank account.

You will receive an email notification when funds are received, if no action is taken on received funds within a reasonable timeframe, they will be automatically returned to your nominated refund bank account and currency.

Local Collection Accounts allow you to receive payments in certain currencies (GBP, EUR, and USD) as if you were a local business. This means payments are processed faster and often incur fewer fees, making it easier for your clients or partners to send you payments without worrying about international transfer costs.

Yes, you can convert the received funds into your preferred currency using Volopa’s competitive exchange rates before transferring them back to your main business bank account.

Yes, you will receive an email notification as soon as funds are received. You can then view the details in the Collections History section and choose how to allocate or use the funds.

You can track all received payments in the Collections History and Recent Activity sections in your Volopa web app. From there, you can download collection reports and generate PDF statements for specific payments or time periods.

There is no strict limit on the amount you can receive. However, large payments may require additional compliance checks depending on the nature and volume of the funds. If you are expecting a large collection, it is best to notify our support team in advance.

If you need to return a payment, you can easily initiate a refund through your Volopa account. Contact our support team if you need assistance or have questions about handling refunds for specific payments.

Absolutely. All funds received are securely held in segregated accounts, and every transaction is screened for compliance and security. We follow strict FCA and international regulations to ensure the highest level of protection for your business.

If you have any questions or need help with the Collections feature, please reach out to our team at customersupport@volopa.com or call us on ☏ +44 20 4600 0471. Our team is available to assist you with any queries you may have.