Volopa client story

"Volopa offers a multitude of features that make our lives easier."

- Rachel Ollerenshaw, Molly Ollys

About Molly Ollys

Molly Ollys aim is to provide support to children suffering from life-threatening illnesses and their families in the UK.

In unimaginably difficult situations, they hope to make the dark days a little brighter by delivering wishes to children, donating their therapeutic toy lion Olly the Brave and his story books, and undertaking bespoke projects with the NHS such as funding the first Consultant in Paediatric Palliative Medicine at Birmingham Children’s Hospital.

The Problem

What services does Molly Ollys offer?

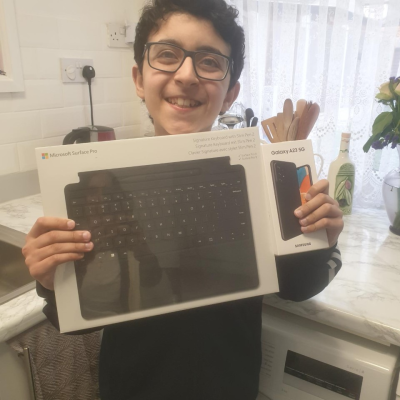

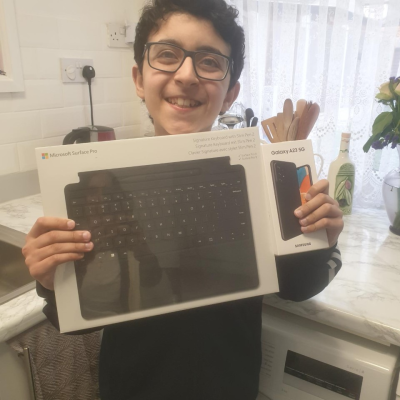

We offer emotional support to children with life-threatening illnesses and their families. We do that through delivering wishes for them to the value of £500 per child, and each wish is as individual as the child; so it could be anything from a virtual reality set for a teenager who’s isolating in hospital so he can connect with his friends, to a piece of equipment that makes life a bit easier for the child and family, such as a professional blender to blend food for a child who needs to be tube fed.

How did you manage your team spending before Volopa?

The honest answer would be, with great difficulty. We tried a variety of different ways to make things work using a normal bank account, but we did not find any one solution which worked for us – until Volopa.

Volopa’s prepaid business cards makes doing the wishes a lot easier, the team don’t have to keep asking me to complete transactions and can get on with organising the wishes without my input, which has been a great help, as we can all work more efficiently.

The Solution

How does Volopa's solution support your team spending?

Volopa has been a much better use of our time, more efficient and quicker to identify transactions that are going through. We have also been able to set transaction limits and top-up accounts for different volunteers and members of staff, giving them more freedom in their day-to-day activities.

How often do you make a purchase to fulfil a wish?

Our financial year goes from 1st of October to the end of September. In the last financial year, we did 454 wishes. There could be several transactions within one Wish application, for example, we could be getting an iPad from one retailer and a case from another or organising a holiday, which would mean, booking the transport separately from the hotel. We use the Volopa cards on a daily basis for wish purposes, as well as other general things within our working day.

The Solution

Who makes these purchases?

We currently have 4 members of staff that would purchase on behalf of families and 3 volunteers that would be issued with a card when they come on board.

The volunteers receive cards that are different to the ones our staff use —for example, they cannot make contactless payments, but rather ones that require approval from our team. This means that everyone in the company can get what they need from a card, but still keep things safe and secure.

Which of the features are the most useful for you?

The easy to use interface which shows me the cards issued to each member of the staff. It very easily shows me the transaction limit set for individuals and lets me top up the shared wallet for the business very conveniently.

We also use QuickBooks to link and automate all our accounts. Volopa offers a multitude of features that make our lives easier.

Smarter tools for smarter businesses

Our platform is packed with a number of helpful tools to save you time and effort so you can focus on the work that counts. Find out more about Volopa’s services online, including our multicurrency prepaid cards. Book a demo with our friendly sales team today.

Securing the best exchange rates

Generally speaking, both banks and payments providers charge a margin, typically via a commission or a percentage-spread, for converting currencies from the funding currency (what you send them) to the payment currency (what the recipient receives). Banks are traditionally risk averse to currency movements due to the size of the portfolio of client assets they hold in multiple currencies. Any shock movement within the currency market can amount to significant losses, and in a bid to mitigate this risk, banks tend to apply higher margins.

International payments providers generally take a different approach, utilising live rates which they transact with immediately. Using this methodology, they don’t need to hold on to funds, the risk is less, and margins can therefore be much lower amounting to better exchange rates for their clients.

Payment Speed

Just as a bank cheque takes time to deposit into an account, so does sending money from one country to another. International FX payments can often take days to reach your recipient if sent via your bank. This is because banks often use manual currency conversion processes and tend to send funds via costly legacy banking networks. If you wish to transfer funds quickly, banks may not be your best option.

Specialist payments providers have established “points-of-difference” in the international payments market through innovative solutions to enable same-day international payments using more robust platforms and security systems. Specialist payment providers tend to route international payments via newer alternative payment rails that are quick, low-cost and easy to track, meaning recipients receive their payments in full and on time, while payment initiators can stay up to date with their payment statuses.

Conclusion

Whilst a bank may provide familiarity, specialised payments providers can offer better FX and payments expertise, superior technology and more cost-effective exchange rates. Through the tailoring of solutions and streamlining compliance requirements, services provided are largely more client-centric and focused. This often amounts to lower fees and charges as well as a superior customer experience for their clients.

Volopa client story

"Volopa offers a multitude of features that make our lives easier."

- Rachel Ollerenshaw, Molly Ollys

About Molly Ollys

Molly Ollys aim is to provide support to children suffering from life-threatening illnesses and their families in the UK.

In unimaginably difficult situations, they hope to make the dark days a little brighter by delivering wishes to children, donating their therapeutic toy lion Olly the Brave and his story books, and undertaking bespoke projects with the NHS such as funding the first Consultant in Paediatric Palliative Medicine at Birmingham Children’s Hospital.

The Problem

What services does Molly Ollys offer?

We offer emotional support to children with life-threatening illnesses and their families. We do that through delivering wishes for them to the value of £500 per child, and each wish is as individual as the child; so it could be anything from a virtual reality set for a teenager who’s isolating in hospital so he can connect with his friends, to a piece of equipment that makes life a bit easier for the child and family, such as a professional blender to blend food for a child who needs to be tube fed.

How did you manage your team spending before Volopa?

The honest answer would be, with great difficulty. We tried a variety of different ways to make things work using a normal bank account, but we did not find any one solution which worked for us – until Volopa.

Volopa’s prepaid business cards makes doing the wishes a lot easier, the team don’t have to keep asking me to complete transactions and can get on with organising the wishes without my input, which has been a great help, as we can all work more efficiently.

The Solution

How does Volopa's solution support your team spending?

Volopa has been a much better use of our time, more efficient and quicker to identify transactions that are going through. We have also been able to set transaction limits and top-up accounts for different volunteers and members of staff, giving them more freedom in their day-to-day activities.

How often do you make a purchase to fulfil a wish?

Our financial year goes from 1st of October to the end of September. In the last financial year, we did 454 wishes. There could be several transactions within one Wish application, for example, we could be getting an iPad from one retailer and a case from another or organising a holiday, which would mean, booking the transport separately from the hotel. We use the Volopa cards on a daily basis for wish purposes, as well as other general things within our working day.

The Solution

Who makes these purchases?

We currently have 4 members of staff that would purchase on behalf of families and 3 volunteers that would be issued with a card when they come on board.

The volunteers receive cards that are different to the ones our staff use —for example, they cannot make contactless payments, but rather ones that require approval from our team. This means that everyone in the company can get what they need from a card, but still keep things safe and secure.

Which of the features are the most useful for you?

The easy to use interface which shows me the cards issued to each member of the staff. It very easily shows me the transaction limit set for individuals and lets me top up the shared wallet for the business very conveniently.

We also use QuickBooks to link and automate all our accounts. Volopa offers a multitude of features that make our lives easier.

Smarter tools for smarter businesses

Our platform is packed with a number of helpful tools to save you time and effort so you can focus on the work that counts. Find out more about Volopa’s services online, including our multicurrency prepaid cards. Book a demo with our friendly sales team today.

Securing the best exchange rates

Generally speaking, both banks and payments providers charge a margin, typically via a commission or a percentage-spread, for converting currencies from the funding currency (what you send them) to the payment currency (what the recipient receives). Banks are traditionally risk averse to currency movements due to the size of the portfolio of client assets they hold in multiple currencies. Any shock movement within the currency market can amount to significant losses, and in a bid to mitigate this risk, banks tend to apply higher margins.

International payments providers generally take a different approach, utilising live rates which they transact with immediately. Using this methodology, they don’t need to hold on to funds, the risk is less, and margins can therefore be much lower amounting to better exchange rates for their clients.

Payment Speed

Just as a bank cheque takes time to deposit into an account, so does sending money from one country to another. International FX payments can often take days to reach your recipient if sent via your bank. This is because banks often use manual currency conversion processes and tend to send funds via costly legacy banking networks. If you wish to transfer funds quickly, banks may not be your best option.

Specialist payments providers have established “points-of-difference” in the international payments market through innovative solutions to enable same-day international payments using more robust platforms and security systems. Specialist payment providers tend to route international payments via newer alternative payment rails that are quick, low-cost and easy to track, meaning recipients receive their payments in full and on time, while payment initiators can stay up to date with their payment statuses.

Conclusion

Whilst a bank may provide familiarity, specialised payments providers can offer better FX and payments expertise, superior technology and more cost-effective exchange rates. Through the tailoring of solutions and streamlining compliance requirements, services provided are largely more client-centric and focused. This often amounts to lower fees and charges as well as a superior customer experience for their clients.

Securing the best exchange rates

Generally speaking, both banks and payments providers charge a margin, typically via a commission or a percentage-spread, for converting currencies from the funding currency (what you send them) to the payment currency (what the recipient receives). Banks are traditionally risk averse to currency movements due to the size of the portfolio of client assets they hold in multiple currencies. Any shock movement within the currency market can amount to significant losses, and in a bid to mitigate this risk, banks tend to apply higher margins.

International payments providers generally take a different approach, utilising live rates which they transact with immediately. Using this methodology, they don’t need to hold on to funds, the risk is less, and margins can therefore be much lower amounting to better exchange rates for their clients.

Payment Speed

Just as a bank cheque takes time to deposit into an account, so does sending money from one country to another. International FX payments can often take days to reach your recipient if sent via your bank. This is because banks often use manual currency conversion processes and tend to send funds via costly legacy banking networks. If you wish to transfer funds quickly, banks may not be your best option.

Specialist payments providers have established “points-of-difference” in the international payments market through innovative solutions to enable same-day international payments using more robust platforms and security systems. Specialist payment providers tend to route international payments via newer alternative payment rails that are quick, low-cost and easy to track, meaning recipients receive their payments in full and on time, while payment initiators can stay up to date with their payment statuses.

Conclusion

Whilst a bank may provide familiarity, specialised payments providers can offer better FX and payments expertise, superior technology and more cost-effective exchange rates. Through the tailoring of solutions and streamlining compliance requirements, services provided are largely more client-centric and focused. This often amounts to lower fees and charges as well as a superior customer experience for their clients.

Securing the best exchange rates

Generally speaking, both banks and payments providers charge a margin, typically via a commission or a percentage-spread, for converting currencies from the funding currency (what you send them) to the payment currency (what the recipient receives). Banks are traditionally risk averse to currency movements due to the size of the portfolio of client assets they hold in multiple currencies. Any shock movement within the currency market can amount to significant losses, and in a bid to mitigate this risk, banks tend to apply higher margins.

International payments providers generally take a different approach, utilising live rates which they transact with immediately. Using this methodology, they don’t need to hold on to funds, the risk is less, and margins can therefore be much lower amounting to better exchange rates for their clients.

Payment Speed

Just as a bank cheque takes time to deposit into an account, so does sending money from one country to another. International FX payments can often take days to reach your recipient if sent via your bank. This is because banks often use manual currency conversion processes and tend to send funds via costly legacy banking networks. If you wish to transfer funds quickly, banks may not be your best option.

Specialist payments providers have established “points-of-difference” in the international payments market through innovative solutions to enable same-day international payments using more robust platforms and security systems. Specialist payment providers tend to route international payments via newer alternative payment rails that are quick, low-cost and easy to track, meaning recipients receive their payments in full and on time, while payment initiators can stay up to date with their payment statuses.

Conclusion

Whilst a bank may provide familiarity, specialised payments providers can offer better FX and payments expertise, superior technology and more cost-effective exchange rates. Through the tailoring of solutions and streamlining compliance requirements, services provided are largely more client-centric and focused. This often amounts to lower fees and charges as well as a superior customer experience for their clients.