FAQs

Frequently asked questions

FAQs Business cards

Start now

You can activate your card using the app or online. Within the ‘Action’ menu, select ‘Activate Card’ and confirm by tapping the ‘Activate Card’ button. Your card will be activated instantly. Your card PIN number will be displayed on screen once your card is activated.

Yes. You can make contactless payments at any merchant terminal which accepts this at home and abroad.

Yes. Volopa is authorised by the UK Financial Conduct Authority (FCA Number 554549) to carry out payment services. The card is issued by Moorwand Financial Services Limited pursuant to a licence by Mastercard International.

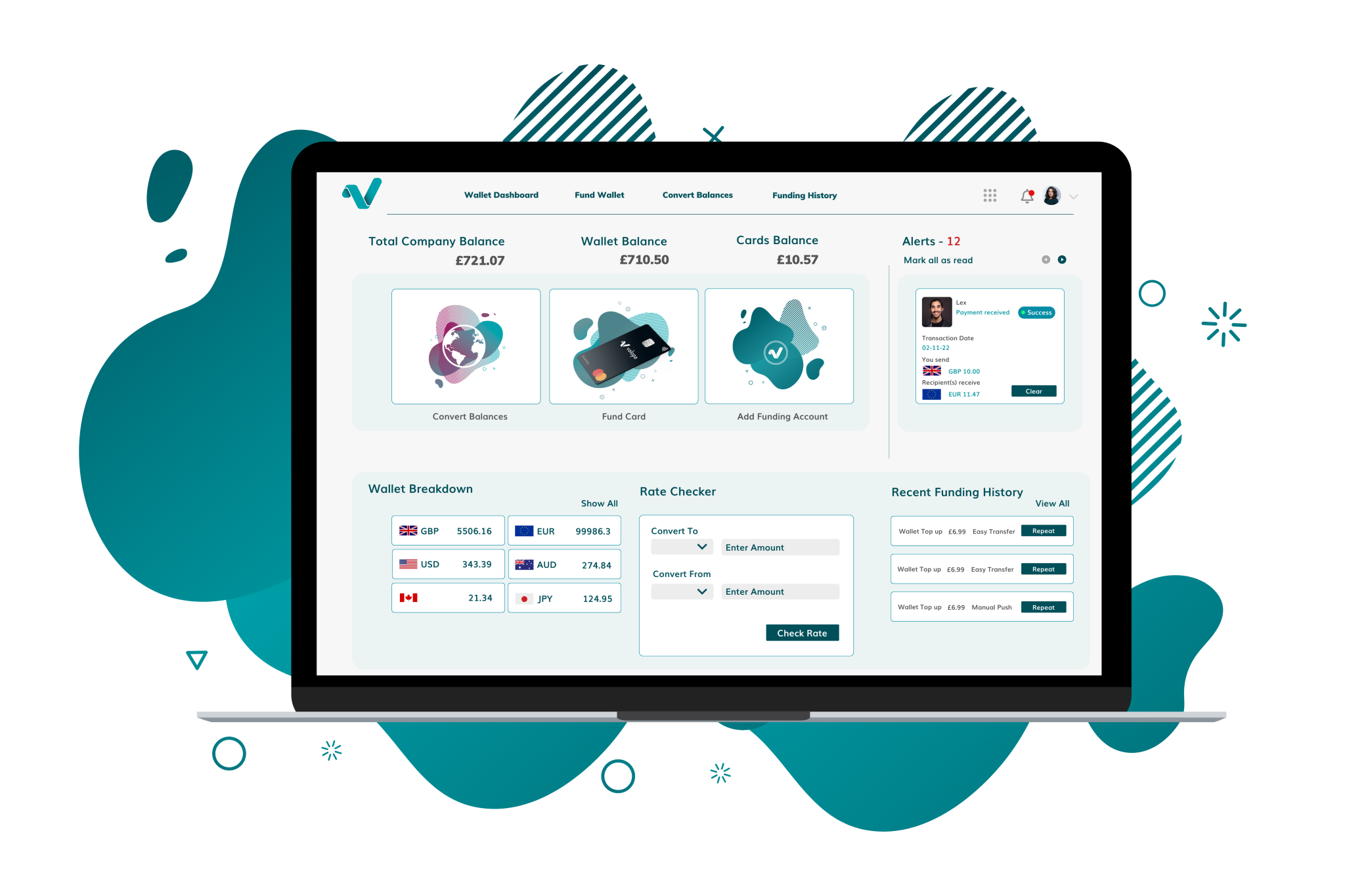

The base currency of your card will either be GBP or EUR. This is identified in the Prepaid Cards dashboard of your online account.

The Volopa card is a multi-currency prepaid payment card. A prepaid card is not linked to a bank account, and you can only spend money that you have already topped-up onto the card providing you with an increased level of control over your expenses. Your Volopa card can hold and spend in up to 14 local currencies. All currency is converted on the card at the real market exchange rate without incurring hidden fees. When spending abroad at a merchant that accepts Mastercard or withdrawing cash from an ATM, the card reader will automatically detect that you have the local currency on the card and take payment in that currency for the value of the transaction. You will not incur foreign transaction charges typically associated with using a debit or credit card abroad. It is like having 14 local cards in your wallet. You can also use your Volopa card in currencies outside of the 14 local currencies as long as you have the base currency on the card.

You can see your PIN by logging into your Volopa app or Volopa online account.

FAQs Business cards

My account

Yes of course. Simply unload currency balances to the Company Wallet and e-mail customersupport@volopa.com or call our customer support team.

You can temporarily freeze and unfreeze your card using the Volopa app or online account. Freezing your card will prevent any transactions from being made on the card while the card remains frozen. You can unfreeze the card at any time if you want to continue using it.

Within the Volopa app select ‘Action’ menu, select ‘Card Controls’ and tap ‘Freeze Card’. Your card will be instantly blocked. You can unblock your card at any time by taping on ‘Unfreeze Card’.

Within your online account go to the Prepaid Cards Dashboard select ‘Prepaid Cards’, select ‘Action’, select Manage Card and select ‘Freeze’. Your card will be instantly blocked. You can unblock your card at any time by selecting ‘Unfreeze’

You can also report your card as lost or stolen which will permanently block the card.

You can change your PIN at any ATM machine that provides this service. You will be asked to enter your existing PIN and to select a new PIN. Please choose a PIN that can’t be easily guessed by anyone else – E.g. don’t use 1111, 1234 or your date of birth.

Your card can only be loaded by either the Primary or Corporate Administrator. Your card can be loaded 24/7 and funds will appear instantly on your card balance.

Volopa, as a payment institution authorised by the Financial Conduct Authority (FCA), along with the regulated Electronic Money Institutions (EMIs) that we work with, are responsible for keeping your money safe, while it is held by us. We, or our partners, do so by placing your funds into a segregated account, known as a “safeguarding account”. Funds held in the safeguarding account are not covered by the Financial Services Compensation Scheme (FSCS).

To ensure your money is safe, your funds held in the segregated accounts are kept separate from our or our partners’ working capital or other funds, and, in the case of an insolvency, would be used to repay you and other clients. This means you should get your money back, except for any costs which may be deducted by the insolvency practitioner for distributing the money to our customers. In addition, due to the insolvency process, it could take longer for money to be returned to you than if the money was covered by FSCS.

If you are a UK international payment customer, funds are safeguarded by Volopa in the manner described above.

If you are a prepaid card customer, the balances on your card are safeguarded by the provider of the Volopa card, Moorwand Limited. Moorwand is an authorised EMI regulated by the FCA in the UK. More details on how Moorwand safeguards your funds can be found in the Frequently Asked Questions section of their website at https://www.moorwand.com/resources/faq/.

If you are a European international payment customer, funds are safeguarded by CurrencyCloud B.V. CurrencyCloud B.V. is an authorised EMI regulated by De Nederlandsche Bank in The Netherlands.

More information about using a non-bank payment service provider and the protections they offer can be found on the FCA’s website at https://www.fca.org.uk/consumers/using-payment-service-providers.

There is no minimum load amount.

Our Customer Support team is here to help Monday to Friday, from 9am to 5pm GMT. You can get in touch on +44 (0) 204 600 0469 or email customersupport@volopa.com

We take great care in the way that we manage and use your personal data. Your data is always kept secure and handled in compliance with the General Data Protection Regulation (GDPR).

You can find our full privacy policy here.

Our terms and conditions can be found here.

FAQs Business cards

My transactions

No, funds can only be returned to the Company Wallet.

Employees with account roles of Primary Administrator, Corporate Administrator or Business User can exchange instantly between currencies on cards 24/7 using the app or online account. Within the “Action” menu, select “Exchange Currency”. Select the currency and amount that you would like to exchange. We will show you the exchange rate and amount of currency that you would be selling and buying before you accept the transaction. The new currency will appear instantly on the relevant cards ready to use.

You can sign up online here. We will need to carry out some checks to verify certain details before we can set up your account.

Typically, we aim to have your account set up within 72 hours once we have received all the required information and documentation.

Our terms and conditions can be found here.

FAQs International payments

Start now

For regulatory reasons, we can only permanently close accounts which haven’t been used in the past 5 years. However, we can always deactivate an account for you.

If you wish to do so, please contact our Customer Support team.

Within the Recipient List, click on a Recipient, tab to the bottom of the page and select ‘Remove Recipient’.

Within the Payment History section of your online account, you can view all your completed and pending International Payments.

Your account may have been blocked for several reasons. This could include suspicious activity having been detected on your account or if you have signed up for multiple accounts.

If your account has been blocked, please contact our Customer Support team.

When the international payment has been sent the status in your online account will be updated to ‘Complete’

When logged into your online account select ‘International Payments’ in the left-hand vertical menu, select ‘New Payment’, select the number of recipients, select ‘Next’, input the data in ‘Create Payment’, select ‘Next’ and then confirm the Payment. For more details see the User Guide “How to Send an international payment.

You instruct your bank to transfer the funds to the Volopa client money account. Details of our bank account will be shown in your online account when you complete an international payment. They will also be provided in the international payment e-mail confirmation.

The length of time it will take for an international payment to be received will vary by country.

There is no minimum or maximum amount although an online limit may be set which will require you to call us for larger transactions. As you use the account and your relationship with Volopa grows this online limit can be increased.

FAQs International payments

My account

Our fees become lower based upon your volumes. When you send amounts above 100,000 GBP (or equivalent), we’ll apply a better rate as we’re able to bulk-purchase your currency at a more competitive rate. Please discuss with your Account Manager if your volumes increase (monthly or one-off payments) and we’ll see what we can do!

FAQs International payments

Our fees and limits

FAQs Client feedback

Complaints procedure

If you have a complaint about any aspect of our service, we would like to hear from you.

You can contact us by telephone or in writing, by post or email, using the following details:

Email: customersupport@volopa.com

Post: 15 Belgrave Square London, SW1X 8PS

Telephone: +44 (0) 204 600 0469 (available Monday – Friday, 9:00am to 5:00pm, excluding holidays)

Please address all correspondence to the Complaints Manager.