Mastering currency volatility with Volopa FX Forwards

Protect your business against currency volatility with Volopa’s FX Forwards Contracts.

With the volatility of the currency markets, predicting costs and revenues from international business can be challenging. This unpredictability can impact your margins and financial planning. FX Forwards are a powerful solution that allows you to lock in a specific exchange rate for future transactions, giving you greater control and predictability.

Understanding FX Forward Contracts

An FX Forward contract is a foreign exchange agreement that allows you to lock in a specific exchange rate for a future transaction. This not only provides stability and predictability but also protects your business from adverse currency movements. Let’s delve into how FX Forwards work and their numerous benefits.

How FX Forward Contracts work

With an open forward contract, you lock in an agreed-upon exchange rate with us for a specified future date. This allows you to convert your currency at that rate anytime before the contract expires, providing flexibility and protection against currency fluctuations. Here’s a simple breakdown of the process:

Set your rate

Agree on a specific exchange rate for a future date.

Flexibility

Convert your currency at this rate anytime before the contract expires.

Protection

Shield your business from unpredictable currency movements.

Key benefits of FX Forwards

- Stability and predictability: Knowing the exact exchange rate you’ll get allows for more accurate budgeting.

- Flexibility: Unlike fixed forwards, open forwards allow you to convert currency at any time within the contract period.

- Hedge against risk: Protect your business from adverse currency movements, reducing uncertainty and stress.

- Competitive edge: With predictable costs, you can price your products or services more competitively in the global market.

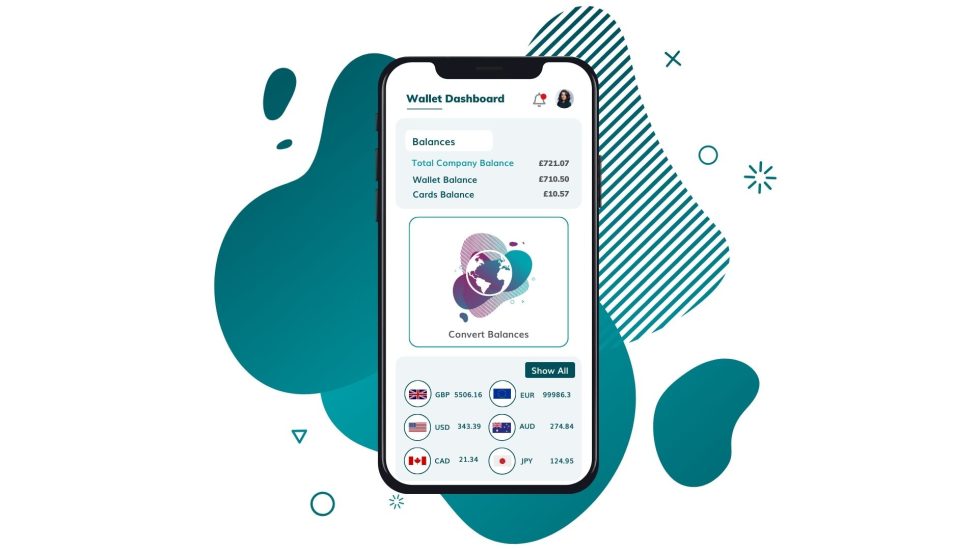

Global reach with Volopa

For businesses operating globally, Volopa provides a seamless solution for managing multicurrency payments and hedging foreign currency exposure. Here’s how we make global business easy:

- Make payments worldwide: Send multicurrency business payments to over 180 countries.

- Hedge currency risks: Lock in exchange rates and protect against currency fluctuations.

- Use your existing bank account: Manage everything from your current UK bank account.

The downside of FX Forward Contracts

- Commitment to the contract: You are obligated to complete the transaction at the agreed rate, regardless of market changes.

- Initial margin requirement: Some contracts may require an initial deposit, which can tie up cash flow.

- No market participation: You cannot benefit from favourable market movements once the rate is locked in.

- Cash flow implications: Ensure you have the necessary funds available on the settlement date.

- Fixed vs. Open Forwards: Fixed forwards require full settlement on a specific date, while open forwards offer flexibility but still require full settlement within a specified period.

Getting started with FX Forwards

Getting started with your FX Forwards is straightforward. You can easily obtain a quote for your Forward contract over the phone. However, keep in mind that FX rates are updated every 30 seconds, and unless booked immediately, the quoted rate may change.

Eligibility Criteria:

- Clients must be based in the UK.

- Must use Volopa for International Payments.

Managing currency volatility is crucial for any business involved in international trade. FX Forward Contracts from Volopa provide a powerful tool to lock in exchange rates, offering stability, predictability, and protection against adverse currency movements.

FAQs

An FX Forward contract is a foreign exchange agreement that allows you to lock in a specific exchange rate for a future transaction. This provides stability and predictability for your international business dealings.

With an open forward contract, you agree on an exchange rate for a specified future date. You can then convert your currency at this rate anytime before the contract expires, giving you flexibility and protection against currency fluctuations.

You can execute currency contracts in GBP, EUR, and USD.

Currently, we offer contracts up to 12 months. For contract tenures longer than 12 months, please contact our sales team.

FX rates are updated every 30 seconds. Unless booked immediately, the quoted rate may change.

FX Forwards offer several benefits:

- Stability and Predictability: Know your exact exchange rate for accurate budgeting.

- Flexibility: Convert currency anytime within the contract period.

- Hedge Against Risk: Protect your business from adverse currency movements.

- Competitive Edge: Predictable costs allow for more competitive pricing in the global market.

To get started, sign up on our website or contact our sales team for more information.