Product Update

We’ve joined forces with Yapily to harness the power of Open Banking

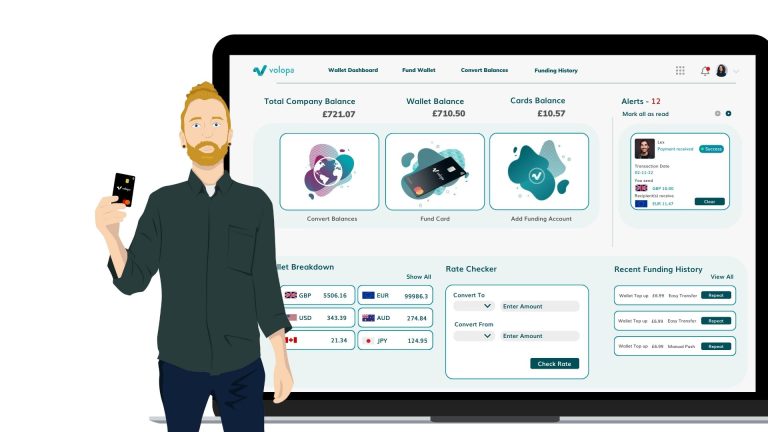

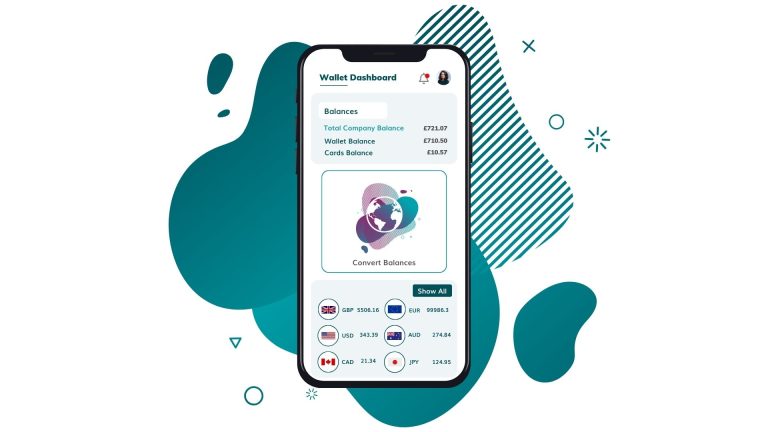

Managing business finances just got easier with Volopa's new Easy Transfer feature. Powered by Yapily Payments, this tool is all about making your life simpler.

In the ever-evolving world of business finance, staying ahead of the curve is not just an advantage, it's a necessity. That's why we are thrilled to announce our Open Banking feature, in partnership with Yapily payments. This new feature marks a significant leap forward in how our UK business clients manage their finances, offering a seamless and efficient funding journey.

The Power of Open Banking

Open Banking, also known as Easy Transfer, is more than a trendy term – it’s a game-changing feature that simplifies payments and wallet funding. It offers a smooth process for making payments and topping up your Volopa Company Wallet, all without leaving the Volopa platform.

Key features and benefits:

Seamless bank connections:

Easy Transfer connects you directly to your bank account. This means when you need to move money, you can do it right from your Volopa account. No more logging into different banking sites – it’s all done in one place, quickly and securely.

Time-saving Integrations:

We know time is precious. That’s why Easy Transfer is designed to save you hours. Whether you’re managing your Volopa Account or handling international payments, this feature makes everything faster.

Reminders for peace of mind:

With our Cards & Expense Management, Easy Transfer works even harder for you. If your account balance gets low, we’ll let you know. Then, with just a few clicks, you can top it up. No hassle, no waiting.

International payments made easy:

For businesses dealing internationally, Easy Transfer is a game-changer. It makes using Volopa’s same-day international payment feature across various regions a breeze. You can send money quickly, without any of the usual complications.

The Easy Transfer feature is part of our commitment to making Volopa the ultimate platform for international payments and expense management. We’re always looking for ways to enhance your experience and make financial management as straightforward as possible.

Good to know:

- Who can use it? Only our UK-based business clients can enjoy this feature right now.

- How many banks are on board? A whopping 60 banks are currently connected with this feature.

- What currencies work? You can use GBP or EUR for funding. That’s because we use Faster Payments & SEPA for these currencies. Need another currency? Our standard Push Funds process has got you covered.

- How much can you move? Up to 75,000 GBP or EUR per transaction. If you need more, we’ll switch you over to Push Funds, but remember, your bank might have its own limits too.

- Bank’s own rules: Different banks, different rules. Some might allow up to £250,000, others cap it at £20,000. Best to check with your bank what your limit is.

- What if there’s a glitch? If Easy Transfer hits a snag, no worries – just give it another go or manually send the funds like you usually would.

- How fast is funding? If you’re funding in GBP, it’s almost instant. But we’ll mark it as pending until we’re sure the funds are cozy in your account, which usually takes just a few seconds to a few minutes.

Remember, this is just a taste of what Open Banking with Volopa can offer – convenient, fast, and tailored for our UK business clients.

How to use it:

International payments via Easy Transfer

Find out how to manage an international payment fund via easy transfer on the Volopa Business web platform.

Funding your wallet via Easy Transfer

Learn how to easily manage your company wallet and fund transfers using the Volopa Business web platform.

Securing the best exchange rates

Generally speaking, both banks and payments providers charge a margin, typically via a commission or a percentage-spread, for converting currencies from the funding currency (what you send them) to the payment currency (what the recipient receives). Banks are traditionally risk averse to currency movements due to the size of the portfolio of client assets they hold in multiple currencies. Any shock movement within the currency market can amount to significant losses, and in a bid to mitigate this risk, banks tend to apply higher margins.

International payments providers generally take a different approach, utilising live rates which they transact with immediately. Using this methodology, they don’t need to hold on to funds, the risk is less, and margins can therefore be much lower amounting to better exchange rates for their clients.

Payment Speed

Just as a bank cheque takes time to deposit into an account, so does sending money from one country to another. International FX payments can often take days to reach your recipient if sent via your bank. This is because banks often use manual currency conversion processes and tend to send funds via costly legacy banking networks. If you wish to transfer funds quickly, banks may not be your best option.

Specialist payments providers have established “points-of-difference” in the international payments market through innovative solutions to enable same-day international payments using more robust platforms and security systems. Specialist payment providers tend to route international payments via newer alternative payment rails that are quick, low-cost and easy to track, meaning recipients receive their payments in full and on time, while payment initiators can stay up to date with their payment statuses.

Conclusion

Whilst a bank may provide familiarity, specialised payments providers can offer better FX and payments expertise, superior technology and more cost-effective exchange rates. Through the tailoring of solutions and streamlining compliance requirements, services provided are largely more client-centric and focused. This often amounts to lower fees and charges as well as a superior customer experience for their clients.

Product Update

We’ve joined forces with Yapily to harness the power of Open Banking

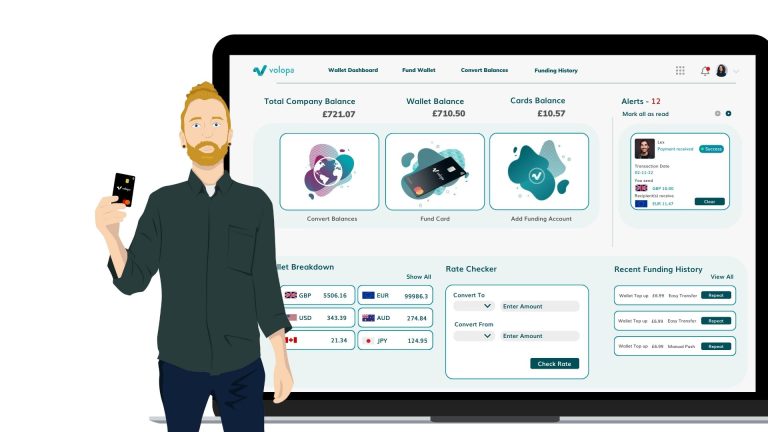

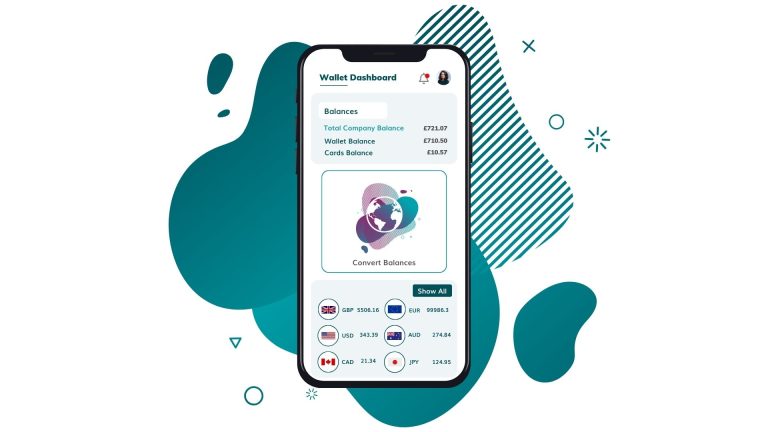

Managing business finances just got easier with Volopa's new Easy Transfer feature. Powered by Yapily Payments, this tool is all about making your life simpler.

In the ever-evolving world of business finance, staying ahead of the curve is not just an advantage, it's a necessity. That's why we are thrilled to announce our Open Banking feature, in partnership with Yapily payments. This new feature marks a significant leap forward in how our UK business clients manage their finances, offering a seamless and efficient funding journey.

The Power of Open Banking

Open Banking, also known as Easy Transfer, is more than a trendy term – it’s a game-changing feature that simplifies payments and wallet funding. It offers a smooth process for making payments and topping up your Volopa Company Wallet, all without leaving the Volopa platform.

Key features and benefits:

Seamless bank connections:

Easy Transfer connects you directly to your bank account. This means when you need to move money, you can do it right from your Volopa account. No more logging into different banking sites – it’s all done in one place, quickly and securely.

Time-saving Integrations:

We know time is precious. That’s why Easy Transfer is designed to save you hours. Whether you’re managing your Volopa Account or handling international payments, this feature makes everything faster.

Reminders for peace of mind:

With our Cards & Expense Management, Easy Transfer works even harder for you. If your account balance gets low, we’ll let you know. Then, with just a few clicks, you can top it up. No hassle, no waiting.

International payments made easy:

For businesses dealing internationally, Easy Transfer is a game-changer. It makes using Volopa’s same-day international payment feature across various regions a breeze. You can send money quickly, without any of the usual complications.

The Easy Transfer feature is part of our commitment to making Volopa the ultimate platform for international payments and expense management. We’re always looking for ways to enhance your experience and make financial management as straightforward as possible.

Good to know:

- Who can use it? Only our UK-based business clients can enjoy this feature right now.

- How many banks are on board? A whopping 60 banks are currently connected with this feature.

- What currencies work? You can use GBP or EUR for funding. That’s because we use Faster Payments & SEPA for these currencies. Need another currency? Our standard Push Funds process has got you covered.

- How much can you move? Up to 75,000 GBP or EUR per transaction. If you need more, we’ll switch you over to Push Funds, but remember, your bank might have its own limits too.

- Bank’s own rules: Different banks, different rules. Some might allow up to £250,000, others cap it at £20,000. Best to check with your bank what your limit is.

- What if there’s a glitch? If Easy Transfer hits a snag, no worries – just give it another go or manually send the funds like you usually would.

- How fast is funding? If you’re funding in GBP, it’s almost instant. But we’ll mark it as pending until we’re sure the funds are cozy in your account, which usually takes just a few seconds to a few minutes.

Remember, this is just a taste of what Open Banking with Volopa can offer – convenient, fast, and tailored for our UK business clients.

How to use it:

International payments via Easy Transfer

Find out how to manage an international payment fund via easy transfer on the Volopa Business web platform.

Funding your wallet via Easy Transfer

Learn how to easily manage your company wallet and fund transfers using the Volopa Business web platform.

Securing the best exchange rates

Generally speaking, both banks and payments providers charge a margin, typically via a commission or a percentage-spread, for converting currencies from the funding currency (what you send them) to the payment currency (what the recipient receives). Banks are traditionally risk averse to currency movements due to the size of the portfolio of client assets they hold in multiple currencies. Any shock movement within the currency market can amount to significant losses, and in a bid to mitigate this risk, banks tend to apply higher margins.

International payments providers generally take a different approach, utilising live rates which they transact with immediately. Using this methodology, they don’t need to hold on to funds, the risk is less, and margins can therefore be much lower amounting to better exchange rates for their clients.

Payment Speed

Just as a bank cheque takes time to deposit into an account, so does sending money from one country to another. International FX payments can often take days to reach your recipient if sent via your bank. This is because banks often use manual currency conversion processes and tend to send funds via costly legacy banking networks. If you wish to transfer funds quickly, banks may not be your best option.

Specialist payments providers have established “points-of-difference” in the international payments market through innovative solutions to enable same-day international payments using more robust platforms and security systems. Specialist payment providers tend to route international payments via newer alternative payment rails that are quick, low-cost and easy to track, meaning recipients receive their payments in full and on time, while payment initiators can stay up to date with their payment statuses.

Conclusion

Whilst a bank may provide familiarity, specialised payments providers can offer better FX and payments expertise, superior technology and more cost-effective exchange rates. Through the tailoring of solutions and streamlining compliance requirements, services provided are largely more client-centric and focused. This often amounts to lower fees and charges as well as a superior customer experience for their clients.

Securing the best exchange rates

Generally speaking, both banks and payments providers charge a margin, typically via a commission or a percentage-spread, for converting currencies from the funding currency (what you send them) to the payment currency (what the recipient receives). Banks are traditionally risk averse to currency movements due to the size of the portfolio of client assets they hold in multiple currencies. Any shock movement within the currency market can amount to significant losses, and in a bid to mitigate this risk, banks tend to apply higher margins.

International payments providers generally take a different approach, utilising live rates which they transact with immediately. Using this methodology, they don’t need to hold on to funds, the risk is less, and margins can therefore be much lower amounting to better exchange rates for their clients.

Payment Speed

Just as a bank cheque takes time to deposit into an account, so does sending money from one country to another. International FX payments can often take days to reach your recipient if sent via your bank. This is because banks often use manual currency conversion processes and tend to send funds via costly legacy banking networks. If you wish to transfer funds quickly, banks may not be your best option.

Specialist payments providers have established “points-of-difference” in the international payments market through innovative solutions to enable same-day international payments using more robust platforms and security systems. Specialist payment providers tend to route international payments via newer alternative payment rails that are quick, low-cost and easy to track, meaning recipients receive their payments in full and on time, while payment initiators can stay up to date with their payment statuses.

Conclusion

Whilst a bank may provide familiarity, specialised payments providers can offer better FX and payments expertise, superior technology and more cost-effective exchange rates. Through the tailoring of solutions and streamlining compliance requirements, services provided are largely more client-centric and focused. This often amounts to lower fees and charges as well as a superior customer experience for their clients.

Securing the best exchange rates

Generally speaking, both banks and payments providers charge a margin, typically via a commission or a percentage-spread, for converting currencies from the funding currency (what you send them) to the payment currency (what the recipient receives). Banks are traditionally risk averse to currency movements due to the size of the portfolio of client assets they hold in multiple currencies. Any shock movement within the currency market can amount to significant losses, and in a bid to mitigate this risk, banks tend to apply higher margins.

International payments providers generally take a different approach, utilising live rates which they transact with immediately. Using this methodology, they don’t need to hold on to funds, the risk is less, and margins can therefore be much lower amounting to better exchange rates for their clients.

Payment Speed

Just as a bank cheque takes time to deposit into an account, so does sending money from one country to another. International FX payments can often take days to reach your recipient if sent via your bank. This is because banks often use manual currency conversion processes and tend to send funds via costly legacy banking networks. If you wish to transfer funds quickly, banks may not be your best option.

Specialist payments providers have established “points-of-difference” in the international payments market through innovative solutions to enable same-day international payments using more robust platforms and security systems. Specialist payment providers tend to route international payments via newer alternative payment rails that are quick, low-cost and easy to track, meaning recipients receive their payments in full and on time, while payment initiators can stay up to date with their payment statuses.

Conclusion

Whilst a bank may provide familiarity, specialised payments providers can offer better FX and payments expertise, superior technology and more cost-effective exchange rates. Through the tailoring of solutions and streamlining compliance requirements, services provided are largely more client-centric and focused. This often amounts to lower fees and charges as well as a superior customer experience for their clients.