Expenses

Managing reimbursable expenses for UK businesses

Reimbursement of employee expenses is an area that can cause confusion and even disagreements between companies and their employees.

In this guide, we will clear up these issues so that HR managers, business leaders and accounting staff will all be on the same page when it comes to paying employees back for business expenses that came out of their own pocket.

By the end, you should know how reimbursement works in theory, in practice and should feel confident to make your reimbursement system run a little (or a lot) smoother.

Expense reimbursement essentials

What is reimbursement?

A reimbursement is a payment made to an employee who has used their own money for a business purpose.

For example, travel expenses made to meet a client, or personal money used to buy catering during a pitch meeting, might be considered reimbursable by that employee’s company. If so, the employee will receive a payment to cover these costs.

Reimbursable expenses differ from billable expenses, which are expenses that a business can charge a client for.

Reimbursable expenses should also not be thought of as refunds, which are paid to customers to reverse a transaction they were unhappy with.

Is reimbursement mandatory?

Employers are not required to reimburse expenses. It depends on the agreement between the employer and the employee (including what is stated in their employment contract).

However, some expenses, including travel during working hours, are very commonly reimbursed. It is considered good practice to do so, and it may be expected by employees, especially in certain lines of work.

Expenses that are commonly reimbursed include:

- Travel within business hours, not including travel to and from home

- Accommodation, if an employee is required to work substantially further from their home than usual

- Team meals (sometimes all meals in certain industries)

- Uniforms

Benefits of reimbursement for employers

Coming up with an expense policy streamlines the work of your employees, empowering them to solve business issues that have costs associated with them without requiring explicit approval from the business.

However, reimbursements are not the only way that employees can handle business expenses. By combining the principle of empowering employees with the idea that employees shouldn’t have to always use their own money to pay expenses, Volopa settled on the solution with prepaid business cards. Read more about this “best of both worlds” expenses management system here.

Is a reimbursement taxable income?

In general, no. If a reimbursement paid to an employee is treated as part of their “income”, and therefore taxable, it would easily put off an employee ever handling any expense, as they would only get a portion of it returned!

HMRC does not consider reimbursements taxable income if they are “necessarily incurred” by the duties of that employment. These payments would be subject to either national insurance or income tax.

If HMRC were required to mediate on a case, they would consider the role of the employee, the duties they were engaged in when the expense was incurred. If the expense was purely for personal benefit, any reimbursement they received would be treated as taxable income.

Read more in the HMRC Employment Income Manual section EIM31645.

Read more in the HMRC National Insurance Manual section NIM05020.

Types of Reimbursement

There are two main methods of reimbursement. You can decide on which best suits your business.

- You reimburse the employee’s exact cost. If a new uniform costs an employee £39.99, they provide the receipt and that’s what you pay back to them.

- You reimburse a flat-rate. If an employee is on a business trip you might reimburse them £5 per day for the cost of breakfast, regardless of what they actually spent on breakfast.

Be aware that each has different rules and reporting requirements. You can see more below under the sections “Does all reimbursement need to be reported to HMRC?”

Paying reimbursements

Are reimbursements paid through payroll?

Reimbursements are sometimes paid through payroll, and sometimes through a separate bank transfer. As the employer, this is for you to decide, but you should be clear about how reimbursements are paid in your reimbursement policy.

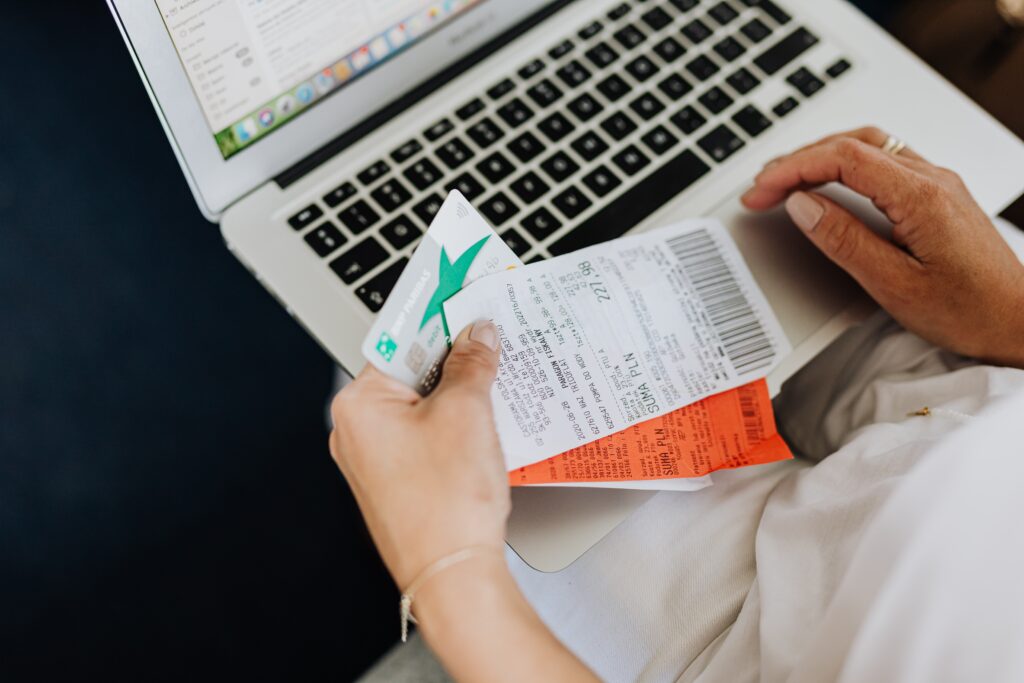

Can a reimbursement be paid if a receipt isn’t provided?

A reimbursement can be paid even if the employee does not supply a receipt for the transaction, but be careful. As the employer, you have to demonstrate to HMRC that the expense is not taxable (ie. it is solely for business use). This is why it is important to ask your employees for evidence of the transaction.

The evidence does not strictly need to be a receipt, but if no receipt is provided, then you should consider if the expense will look reasonable to HMRC. Could the employee instead supply a copy of the relevant bank transaction along with detailed notes of what the purchase was for? This might be sufficient evidence in some cases.

However, asking for a full VAT receipt is always the best policy. As an employer, you will have to use your own discretion on whether to reimburse expenses without one.

There’s another reason employees should provide a full VAT receipt. As these are business expenses being paid for, the company can claim back VAT on these purchases, but only if there is evidence of VAT being paid. This is especially relevant for purchases of more than £250. Though the company may be happy to reimburse the employee, they can’t claim back the VAT for themselves without the appropriate evidence.

Accounting reimbursements

Does all reimbursement need to be reported to HMRC?

It depends. Some expenses do not need to be reported to HMRC at all. In 2016, the system was simplified, so that common reimbursements are accepted by HMRC and do not need to be reported.

In the following cases, you do not need to report reimbursement:

- If you are reimbursing for business travel, phone bills, business entertainment expenses, uniform or tools for work, and you pay the employee their exact costs (as opposed to a flat rate).

- If you pay a flat-rate reimbursement that is equal to or less than HMRC’s benchmark scale rates.

- If you have acquired an exemption with HMRC for a custom rate for your employees, which usually lasts 5 years, you do not need to report these reimbursements.

All other reimbursements should be reported to HMRC with the P11D form, or through your payroll software.

You should still collect evidence of transactions from your employees, even if you don’t have to report the expenses. If you pay out a flat rate, you don’t need to check every receipt, but you should check a sample of them.

Reimbursable expenses examples

To better understand what expenses a employer is safe to reimburse to their employees without there being a tax implication, here are some examples:

Expenses that ARE reimbursable

Example 1: John is a salesperson who travels to client workplaces to pitch his companies products. He travels in his own car which he buys petrol for on his personal debit card.

This expense IS reimbursable. This expense is necessary for the duty, and it can reasonably be expected that any salesperson with similar duties might have similar expenses.

Example 2: Rebecca works from home three days a week, and on these days she exclusively uses her own phone.

Similarly to above, it would be reasonable for Rebecca to claim her phone tariff back from the employer as a reimbursable expense.

Example 3: Riona is a product manager who is attending a conference in Europe where she will talk about the company’s product. The hotels were booked by the company, but she buys her meals with her own cash.

The hotel is an employee expense but as it was paid for by the company it doesn’t need to be reimbursed. The meals, however, can be reimbursed, if they company provides a meal allowance. This is a common benefit for employees who have to travel as part of their job.

HMRC provides guidelines around “travel and subsistence” costs.

Expenses that are NOT reimbursable

Example 1: Beth takes her personal car to client meetings outside of her usual place of work. Sometimes, she will stop off on the way to get her car cleaned.

HMRC is unlikely to consider the cost of the cleaning as “necessarily incurred” by the duties of the job. Having a clean car is not required for her to complete her tasks. Therefore, it would not be correct to consider this expense as reimbursable.

Example 2: Elliot is a single father who hires a babysitter to look after his infant daughter while he is at work in the role of an advertising executive.

As it is not reasonable to conclude that the requirement for babysitting arises out of the duties of his job — not all advertising executives will incur the cost of babysitting — this is not a reimbursable expense, though Elliot may be able to receive other types of support for childcare through his employer.

Example 3: While at work, Guy gets his expensive coat stolen from the coat room.

While Guy may feel out of pocket due to an event that occurred at work, and the company may want to consider why this theft occurred, HMRC wouldn’t consider the cost of a new coat to be reimbursable.

Responsibilities of the employer

- Set a clear and fair expenses policy, including:

- What expenses are reimbursed?

- What is the limit on reimbursement?

- What evidence of expenses is acceptable?

- What format must the employee expense report be in?

- What is the deadline to complete the expenses report?

- Verify expenses:

- Confirm all reimbursements requested match a valid receipt.

- Confirm the sum of expenses do not exceed the allowance for the given period

- Make reimbursement payments to employees within the agreed timescale (usually once a month, either on or separate to the payroll).

- Report reimbursements along with other expenses to HMRC once per year using the P11D form, or through your payroll system, if necessary.

- Set a clear and fair expenses policy, including:

Responsibilities of your employees

- Not exceed the expenses limit agreed with the employer.

- Only pay for expenses of the type agreed with the employer.

- When claiming for reimbursement, provide an expenses report that covers a period as decided by the employer (usually one month).

- Provide evidence for each expense (for example, a receipt, invoice, or written confirmation)

- Give all relevant documentation to the person in charge of expenses by the deadline set by the employer.

Tips to manage reimbursements

Write a clear expenses policy

Be very clear about what is reimbursable and what is not in your policy. The rules should leave no room for confusion or debate, or you are sure to upset some of your employees sooner or later.

Keep paperwork organised

Expense management covers multiple employees, each with their own collection of paperwork, and potential each subject to a different expense policy depending on their role in the business. This can get confusing, so make sure that as soon as a receipt comes to you, it is filed appropriately. Digitisation can make this process easier.

Make life easier with tools

Smaller companies might be used to handing over physical copies of receipts to their HR manager, who manually inputs the expense and the reimbursement into their payroll system. However, modern tools have made this process redundant.

Companies that take advantage of expenses management solutions can save time for employees and HR/payroll staff. Receipt capture means that employees don’t have to carry around the paper copies and physically hand them over (when there is always a chance they could get lost). Such software can also automatically generate expense reports to provide visibility to management.

Report and audit expenses regularly

Expenses can tell you a lot about your business. Regular reports give you the visibility that you need. You should sort payments by transaction type and also by business department, so you can see where the money is going and what value it is providing for the business. From this, you can improve your expense policy to cut out unnecessary spending or to provide higher limits where they are needed. For best results, use expense management software to see spending in real-time, automatically generate reports and audits.

Get a grip on expenses with Volopa

Volopa is the expense management solution that saves teams from lengthy expense admin and empowers employees to get stuff done.

The pillars of the Volopa expense management system are:

- prepaid business cards so employees can make necessary purchases with company money without exceeding set limits, removing the need for reimbursements altogether

- software to track expenses and generate reports

- an app that enables receipt capture and holds a record of all transactions on-the-go

Get started for free today, or contact us for a bespoke solution.

Find out more about what Volopa can do for you